Helpful Info

Investors

Latest Performance

For details, please refer to "Consolidated Financial Results for the Fiscal Year Ended March 31, 2025".

Consolidated Financial Results for the Fiscal Year Ended March 31, 2025 (April 1, 2024 to March 31, 2025)

Consolidated operating results (Percentage figures denote YoY changes)

| (Unit: Millions of yen) | Year Ended March 31, 2024 | Year Ended March 31, 2025 | YoY Change % |

|---|---|---|---|

| Net sales | 141,923 | 140,581 | (0.9) |

| Operating profit | 11,827 | 15,295 | 29.3 |

| Ordinary profit | 12,947 | 16,462 | 27.1 |

| Profit attributable to owners of parent | 11,695 | 11,158 | (4.6) |

Consolidated balance sheets (summary)

| (Unit: Millions of yen) | Year ended March 31, 2024 (as of March 31, 2024) |

Year ended December 31, 2025 (as of March 31, 2024) |

Increase / Decrease |

|---|---|---|---|

| Assets | |||

| Total current assets | 64,848 | 69,841 | 4,992 |

| Total non-current assets | 33,543 | 29,112 | (4,430) |

| Total assets | 98,392 | 98,953 | 561 |

| Liabilities | |||

| Total current liabilities | 30,622 | 26,770 | (3,852) |

| Total non-current liabilities | 11,775 | 15,935 | 4,160 |

| Total liabilities | 42,398 | 42,706 | 307 |

| Net assets | |||

| Total net assets | 55,993 | 56,247 | 254 |

| Total liabilities and net assets | 98,392 | 98,953 | 561 |

Consolidated statement of cash flows (summary)

| (Unit: Millions of yen) | Year Ended March 31, 2024 | Year Ended March 31, 2025 | Increase / Decrease |

|---|---|---|---|

| Cash flows from operating activities | 5,563 | 7,779 | 2,215 |

| Cash flows from investing activities | (4,101) | 1,100 | 5,202 |

| Cash flows from financing activities | (3,145) | (13,520) | (10,374) |

| Effect of exchange rate change on cash and cash equivalents | 0 | (18) | (19) |

| Net increase (decrease) in cash and cash equivalents | (1,683) | (4,660) | (2,976) |

| Cash and cash equivalents at beginning of period | 36,497 | 34,814 | (1,683) |

| Increase in cash and cash equivalents resulting from inclusion of subsidiaries in consolidation | - | 700 | 700 |

| Cash and cash equivalents at end of period | 34,814 | 30,854 | (3,959) |

1. Overview of operating results

(1) Overview of operating results

During the fiscal year under review, the global economy as a whole showed signs of recovery, as the effects of monetary tightening policies in major economies gradually eased. In the Japanese economy, although prices rose, personal consumption recovered and corporate capital investment increased. In addition, the tourism and entertainment industry, which captured inbound demand, was revitalized. In particular, the Japanese content industry, represented by anime, movies, and games, is highly regarded around the world for its innovative technologies and creativity.

Under these circumstances, we made steady progress toward achieving sustainable growth and long-term corporate value creation based on our corporate philosophy of “The Greatest Leisure for All People.”

In the content and digital segment, we accomplished our first-year mission in the “five-year medium-term management plan” announced in May 2024. In addition, we reached a broad agreement on a business alliance with the Alibaba.com Japan Co., Ltd., which has been preparing to accelerate the global EC.

In the amusement equipment business*, pachinko/pachislot (hereinafter, “PS”) machine with a leading IP was well received in the marketplace and drove results for the fiscal year under review.

Consequently, the consolidated results for the fiscal year under review were net sales ¥140,581 million (down 0.9% YoY), operating profit ¥15,295 million (up 29.3% YoY), ordinary profit ¥16,462 million (up 27.1% YoY), and profit attributable to owners of parent ¥11,158 million (down 4.6% YoY).

*Renamed “PS business” from the current fiscal year

The overview of each business segment is as follows.

Content and digital segment

In May 2024, Tsuburaya Productions Co., Ltd. announced its first-year mission in the “five-year medium-term management plan.” In the fiscal year under review, the Company worked to build overseas bases and thereby cultivate new distribution system and strengthen the human resources that play a central role in promoting business.

Total in licensing, MD (product sales), and imaging and event-related revenues for the fiscal year under review amounted to ¥11,165 million, up 13.5% from the previous fiscal year. The breakdown by category is as follows.

<Licensing revenue: ¥6,836 million (up 11.6% YoY)>

In China, sales of block toys, low-priced toys, stationery, apparel, and daily necessities were strong, driving an increase in licensing revenue.

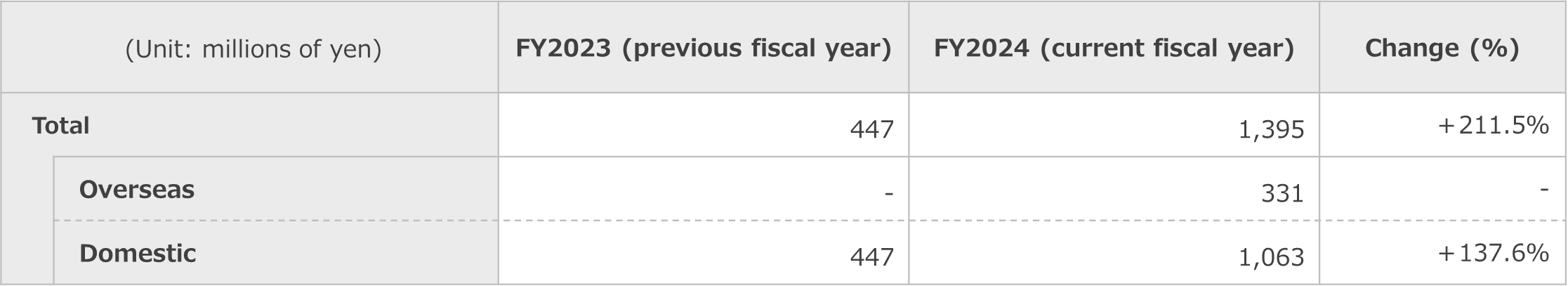

<MD (product sales) revenue: ¥1,395 million (up 211.5% YoY)>

In addition to our traditional in-house planning and merchandise, we released our new product, ULTRAMAN CARD GAME twice globally in the second half of the fiscal year. As a result, MD (product sales) revenues increased. In the future, we will launch a new merchandise for ULTRAMAN CARD GAME every quarter.

<Revenue from imaging and events: ¥2,933 million ((10.1)% YoY)>

Revenue from imaging and events decreased due to a reactionary decline in revenue related to the Tsuburaya Convention, a large-scale event for fans held in the previous fiscal year.

Digital Frontier Inc. made steady progress in VFX production for Netflix titles, such as City Hunter, leveraging its leading-edge technology in video production, and in consigned development of large-scale anime movies and opening movies for game software.

As a consequence, net sales of the content and digital business segment for the fiscal year under review was ¥16,410 million, an increase of 7.0% from the previous fiscal year. In terms of expenses, we invested approximately ¥1 billion in temporary cost for TVCM and other items associated with the launch of the card game business. In addition, we worked to build overseas bases and secure human resources to develop merchandise and strengthen our distribution network. As a result, operating profit was ¥2,835 million (down 25.0% YoY).

Amusement equipment business segment

In this business segment, ACE DENKEN Co., Ltd., (hereinafter, “ACE DENKEN”) a leading company in the installation of equipment for pachinko halls, joined our group from the fiscal year under review, and expanded the range of services to include not only PS machine sales by FIELDS CORPORATION (hereinafter, “FIELDS”) but also new business domains such as peripheral equipment and construction, establishing a management foundation as an amusement equipment business that further contributes to the development of the industry.

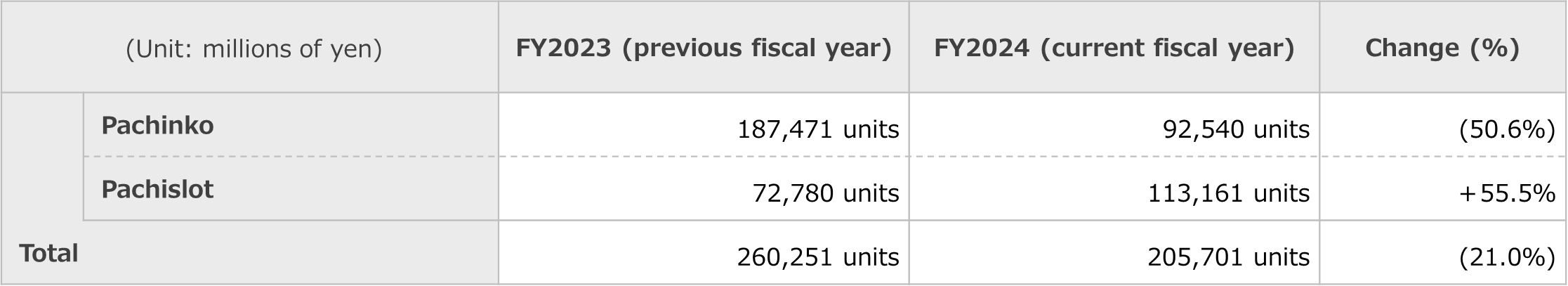

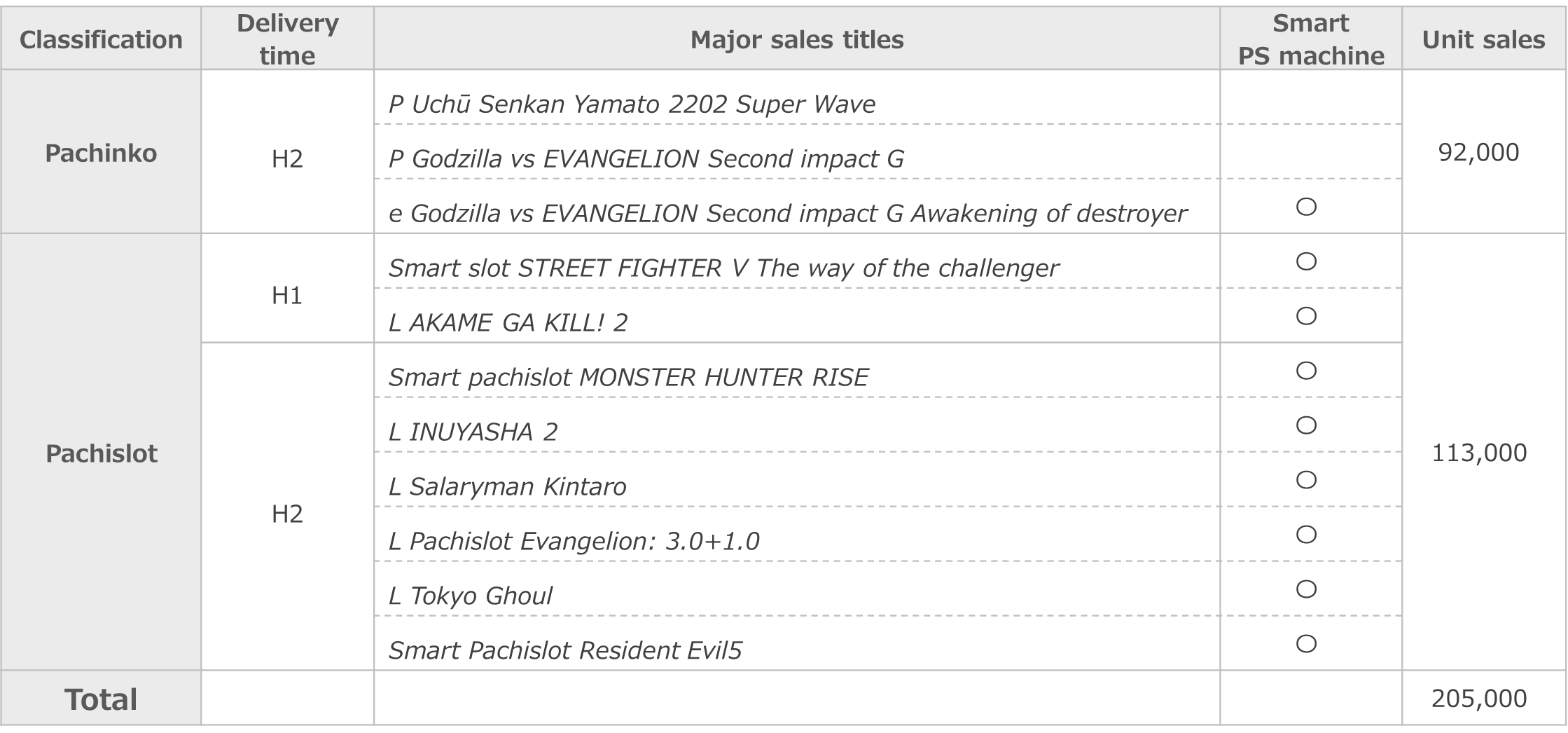

In the first half of the fiscal year under review, we forecast that pachinko hall’s purchasing power would be concentrated in the second half of the year due to the introduction of new banknotes in the first half of the year, and FIELDS launched a leading merchandise in the second half of the year. Consequently, several pachislot machines with leading IP, including L Tokyo Ghoul, gained a strong reputation in the marketplace and contributed significantly to earnings. In addition, the performance of ACE DENKEN was also favorable, so we carried over the sales of several titles among the lineups planned at the beginning of the fiscal year to the first quarter of the following fiscal year and made refinements. As a result, net sales decreased compared to the forecast, but operating profit exceeded the forecast. All sales of PS machines carried over to the first quarter of the following year have been completed as planned.

As a consequence, the amusement equipment business segment recorded net sales of ¥123,092 million, down 2.0% YoY, and operating profit of ¥15,277 million, up 46.7%.

[PS machine unit sales and major sales titles]

Other business

In other business, consolidated operating results for the fiscal year under review were net sales ¥1,682 million and operating profit ¥5 million.

(2) Outlook for the next fiscal year (FY2025)

Contents and digital segment

In the content and digital business, in order to establish a global business centered on IP and achieve significant earnings growth, we will steadily carry out our mission, which is the second term of our five-year medium-term management plan.

Since the launch of Ultraman series on television in 1966, it has been popular with people all over the world as one of Japan’s leading specialty films for entertainment. In 2026, it will mark the 60th anniversary of the start of broadcasting. With this commemorative year in mind, we have positioned the next fiscal year as a key growth phase and will further focus on expanding merchandise and distribution in China, the Asian region, North America, and other regions worldwide.

<Licensing revenues>

In China, we will continue to provide merchandise for attractive Ultraman goods, mainly toys, stationery, apparel, and daily necessities. Furthermore, while expanding the successful model to the surrounding Asian region, we will work to grow our business by expanding our distribution network with local partners.

Domestically, we will strengthen and expand collaboration with leading licensees and other entities centered on Ultraman series 60th anniversary, as well as collaboration in corporate advertising and other areas.

<MD (product sales) income>

In terms of EC, as mentioned above, we reached a broad agreement on a business alliance with Alibaba Japan. At present, we are planning to open a flagship store in Tmall at the end of June 2025. From July 10, “Ultraman Day” (registered by the Japan Memorial Day), we will begin to reserve and sell original figures of Ultraman Tiga, which is popular in Japan and overseas among the series specifically developed for this opening, and will deliver new collections to fans around the world. Furthermore, over the next three years, we will gradually expand our merchandise lineup with the aim of expanding to approximately 500 merchandise.

Furthermore, we will utilize the infrastructure of major partners, such as China’s local travel reservation platform and payment services for inbound travelers to Japan. In the future, we will advance discussions on initiatives to capture demand from foreign visitors to Japan (inbound tourists). Through this, we will build an experiential design that links popular events and content in Japan with travel and purchasing behavior, and provide new value for more fans.

In the card game business, we will work to promote ULTRAMAN CARD GAME using SNS and other tools to strengthen sales of the new merchandise globally.

<Revenues from imaging and events>

We will develop visual products in many regions around the world. In North America, we will significantly expand our video content distribution and broadcasting network through partnerships with Amazon Prime Video and other leading local distribution platform operators. At the same time, we will expand live shows and events, mainly in Asia.

At the event, we will hold the “Tsuburaya Convention” in September this year.

As a consequence, the content and digital business segment forecasts a 15.8% YoY increase in net sales to ¥19,000 million and a 12.9% increase in operating profit to ¥3,200 million.

Amusement equipment business segment

In the amusement equipment business, we have formulated a three-year business plan that includes ACE DENKEN. At FIELDS, we are implementing initiatives to sell 12 titles of attractive PS machine annually. ACE DENKEN plans to expand its share of sales and optimize costs through sales collaboration with FIELDS.

A summary of the three-year business plan is scheduled to be published on the Company’s website on May 14, 2025.

In the next fiscal year, the amusement equipment business segment forecasts a 5.6% YoY increase in net sales to ¥130,000 million and a 2.1% increase in operating profit to ¥15,600 million. In PS machine sales, we expect to sell approximately 250,000 units. We have already sold two pachinko titles and three pachislot titles as the main titles in the first quarter, and all of them have been sold out. We will also continue to respond to the increased production of several titles sold in the previous fiscal year.

In order to ensure the execution and achievement of our missions in each business segment, we will also strengthen our management structure from the perspectives of both finance and governance.

From a financial perspective, while ensuring a sound financial position, we will allocate the cash generated from operations to strategic growth-oriented investments, such as the multifaceted utilization of IP in various business domains, and to shareholder returns, with the aim of improving capital-efficiency.

In terms of governance, we will develop and strengthen our governance system in accordance with global standards in order to maximize the Group’s corporate value. The group nomination and compensation committee and the group sustainability committee have already been established as advisory bodies to board of directors. In the next fiscal year, we will transition to a company with an audit and supervisory committee. From the standpoint of separating supervision and execution, we are responsible for systematizing our efforts in risk management and the discovery of opportunities that contribute to the sustainability of our business and society. By strengthening these management bases, we will deepen our efforts to create medium-to-long-term corporate value.

In light of the above, for the next fiscal year, we are forecasting a 6.7% increase in net sales to ¥150,000 million, a 4.6% increase in operating profit to ¥16,000 million, a 2.2% decrease in ordinary profit to ¥16,100 million, and a 0.4% increase in profit attributable to owners of parent to ¥11,200 million.

(3) Basic policy on profit distribution and dividends for the current and next fiscal years

We regard the improvement of corporate value as an important management issue, and have adopted a basic policy of paying dividends in line with profits.

We recognize that continuous investment for business growth is indispensable for our group, which is developing global content business. We will realize steady business growth and profit growth, and provide shareholder returns, including dividends, while taking into account the balance with business investment.

The year-end dividend for the fiscal year under review will be ¥50, an increase of ¥10 per share from the initial plan. This matter is scheduled to be discussed at the 37th Annual General Meeting of Shareholders to be held on June 18, 2025.

For the next fiscal year, we plan to pay a year-end dividend of ¥50 per share.

(Note 1) All figures in this report are based on published figures for each company and organization or our estimates.

(Note 2) Merchandise names in this report are trademarks or registered trademarks of each company.

(4) Overview of financial position for the fiscal year under review

- Assets

Current assets increased by ¥4,992 million from the end of the previous fiscal year to ¥69,841 million. This was mainly due to an increase in work in process.

Property, plant and equipment increased by ¥1,089 million from the end of the previous fiscal year to ¥10,230 million. This was mainly due to an increase in tools, furniture and fixtures and land.

Intangible assets decreased by ¥286 million from the end of the previous fiscal year to ¥2,116 million. This was mainly due to a decrease in goodwill.

Investments and other assets decreased by ¥5,233 million from the end of the previous fiscal year to ¥16,765 million. This was mainly due to a decrease in investment securities.

Consequently, assets increased by ¥561 million from the end of the previous fiscal year to ¥98,953 million. - Liabilities

Current liabilities decreased by ¥3,852 million from the end of the previous fiscal year to ¥26,770 million. This was mainly due to a increase in trade payables and an decrease in short-term borrowings.

Non-current liabilities increased by ¥4,160 million from the end of the previous fiscal year to ¥15,935 million. This was mainly due to an increase in long-term borrowings.

Consequently, liabilities increased by ¥307 million from the end of the previous fiscal year to ¥42,706 million. - Net assets

Net assets increased by ¥254 million from the end of the previous fiscal year to ¥56,247 million. This was mainly due to an increase in retained earnings and an decrease in non-controlling interests.

(5) Overview of cash flows for the fiscal year under review

Cash and cash equivalents (hereinafter, “cash”) at the end of the fiscal year under review decreased by ¥3,959 million from the end of the previous fiscal year to ¥30,854 million.

Cash flows for the fiscal year under review are summarized as follows:

- Cash flows from operating activities

Net cash provided by operating activities was ¥7,779 million (¥5,563 million provided in the same period of the previous fiscal year). This was mainly due to profit before income taxes of ¥16,252 million, an increase in inventories of ¥5,679 million, income taxes paid of ¥4,542 million, an increase in trade receivables of ¥3,050 million, an increase in trade payables of ¥1,704 million and depreciation of ¥1,180 million. - Cash flows from investing activities

Net cash provided by investing activities was ¥1,100 million (¥4,101 million used in the same period of the previous fiscal year). This was mainly due to ¥2,416 million for proceeds from sales of shares of entities accounted for using equity method, ¥1,390 million for purchase of non-current assets and ¥388 million for loan advances. - Cash flows from financing activities

Net cash used in financing activities was ¥13,520 million, compared with net cash used of ¥3,145 million in the same period of the previous fiscal year. This was mainly due to purchase of treasury shares of ¥6,310 million, proceeds from long-term borrowings of ¥6,280 million, decrease in short-term borrowings of ¥5,100 million, purchase of shares of subsidiaries not resulting in change in scope of consolidation of ¥3,037 million, repayments of long-term borrowings of ¥2,961 million and dividends paid of ¥2,615 million.