Helpful Info

Investors

Financial Indicator

The below shows semiannual (key) financial indicators for five business years.

For details of financial data, please refer to "Financial Data Sheets".

-

Consolidated

*The Company has applied the “Accounting Standard for Revenue Recognition” (ASBJ Statement No. 29, March 31, 2020) and other standards from the beginning of the FY2021.

*Figures for the as of Mar. 31, 2024 reflect the “Accounting Standard for Current Income Taxes (ASBJ Statement No. 27, October 28, 2022)” and others.

Furthermore, the Company has finalized the provisional accounting for the business combination,

and the figures for the fiscal year ended March 31, 2024 have been adjusted to reflect this finalization.

Indicators per share

| (Unit: Yen) | Year Ended March 31, 2021 |

Year Ended March 31, 2022 |

Year Ended March 31, 2023 |

Year Ended March 31, 2024 |

Year Ended March 31, 2025 |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| As of Sep. 30, 2020 |

As of Mar. 31, 2021 |

As of Sep. 30, 2021 |

As of Mar. 31, 2022 |

As of Sep. 30, 2022 |

As of Mar. 31, 2023*2 |

As of Sep. 30, 2023 |

As of Mar. 31, 2024 |

As of Sep. 30, 2024 |

As of Mar. 31, 2025 |

|

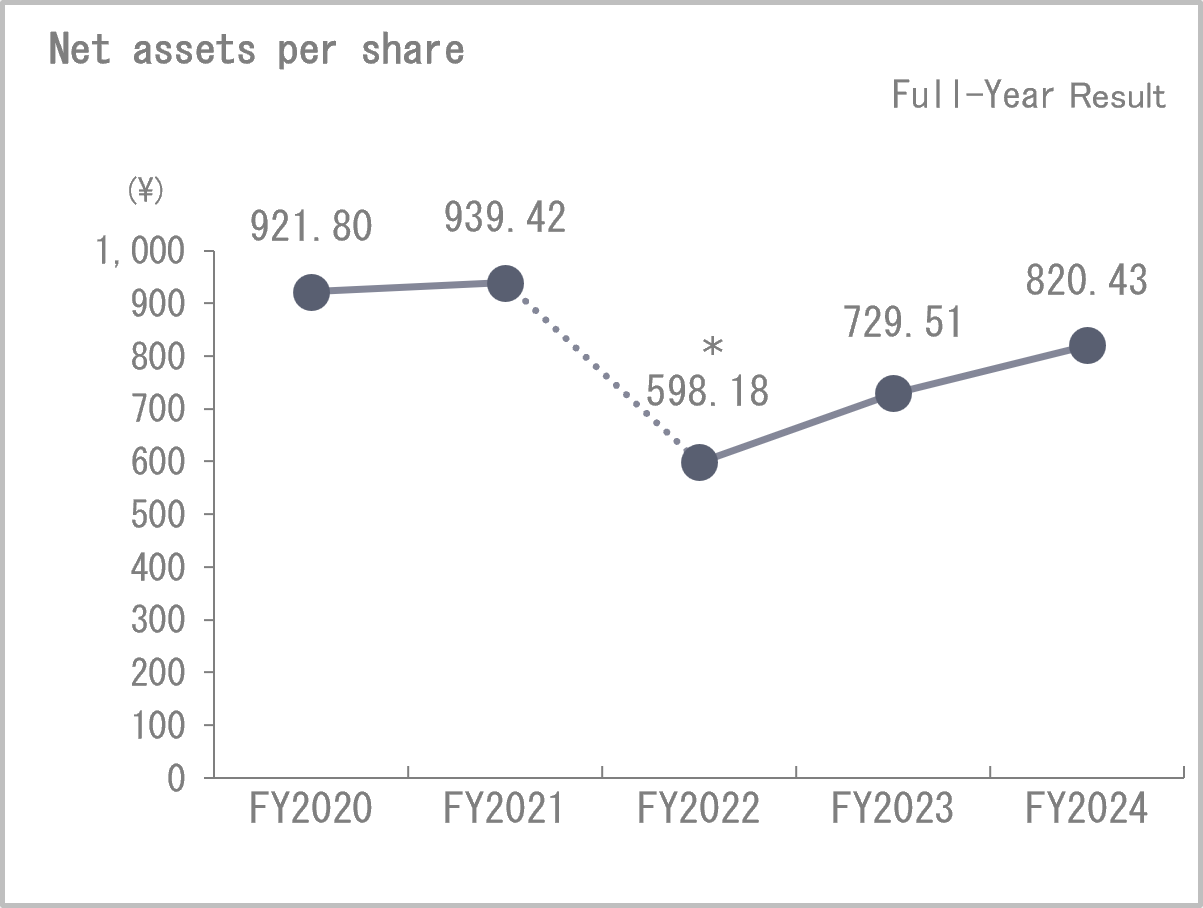

| Net assets per share | 904.97 | 921.80 | 873.17 | 939.42 | 993.76 | 598.18 | 613.14 | 729.51 | 708.16 | 820.43 |

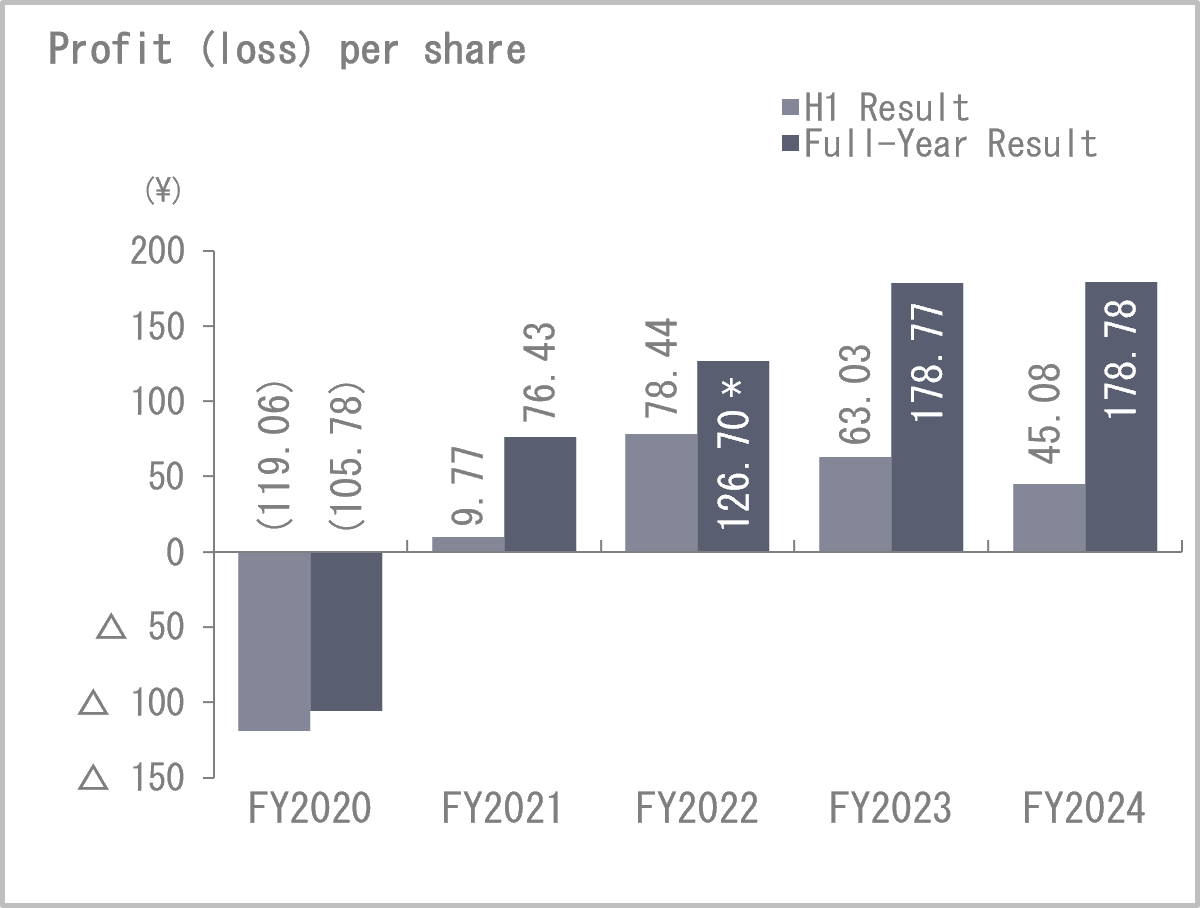

| Profit (loss) per share*1 | (119.06) | (105.78) | 9.77 | 76.43 | 78.44 | 126.70 | 63.03 | 178.77 | 45.08 | 178.78 |

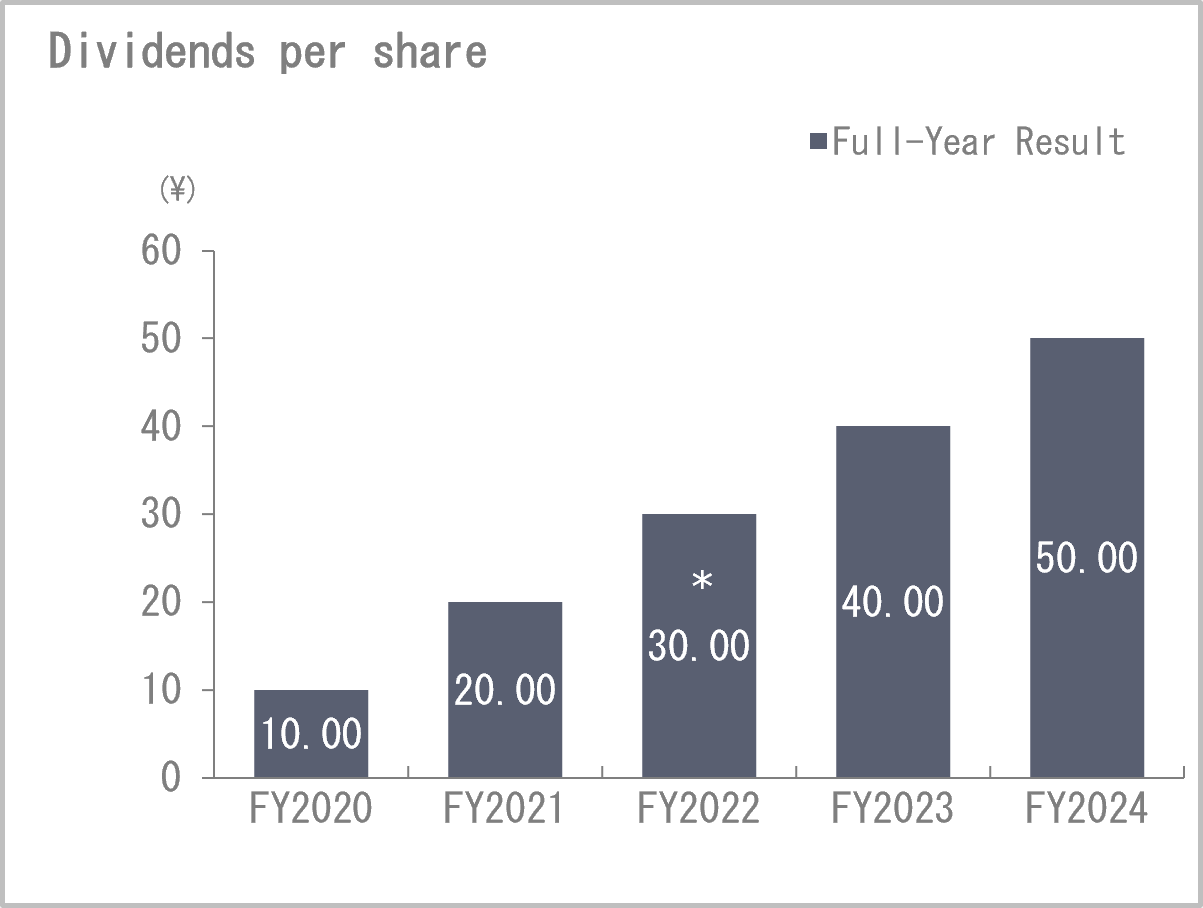

| Dividends per share | - | 10.00 | - | 20.00 | - | 30.00 | - | 40.00 | - | 50.00 |

*1Profit (loss) per share is indicated by figures for the first-half/full-year.

*2On March 22, 2023, we conducted a 2-for-1 stock split of our common share.

Per share indicators for the fiscal year ended March 31, 2023/full-year are calculated taking such stock split into consideration.

Management indicators

| (Unit: %) | Year Ended March 31, 2021 |

Year Ended March 31, 2022 |

Year Ended March 31, 2023 |

Year Ended March 31, 2024 |

Year Ended March 31, 2025 |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| As of Sep. 30, 2020 |

As of Mar. 31, 2021 |

As of Sep. 30, 2021 |

As of Mar. 31, 2022 |

As of Sep. 30, 2022 |

As of Mar. 31, 2023*2 |

As of Sep. 30, 2023 |

As of Mar. 31, 2024 |

As of Sep. 30, 2024 |

As of Mar. 31, 2025 |

|

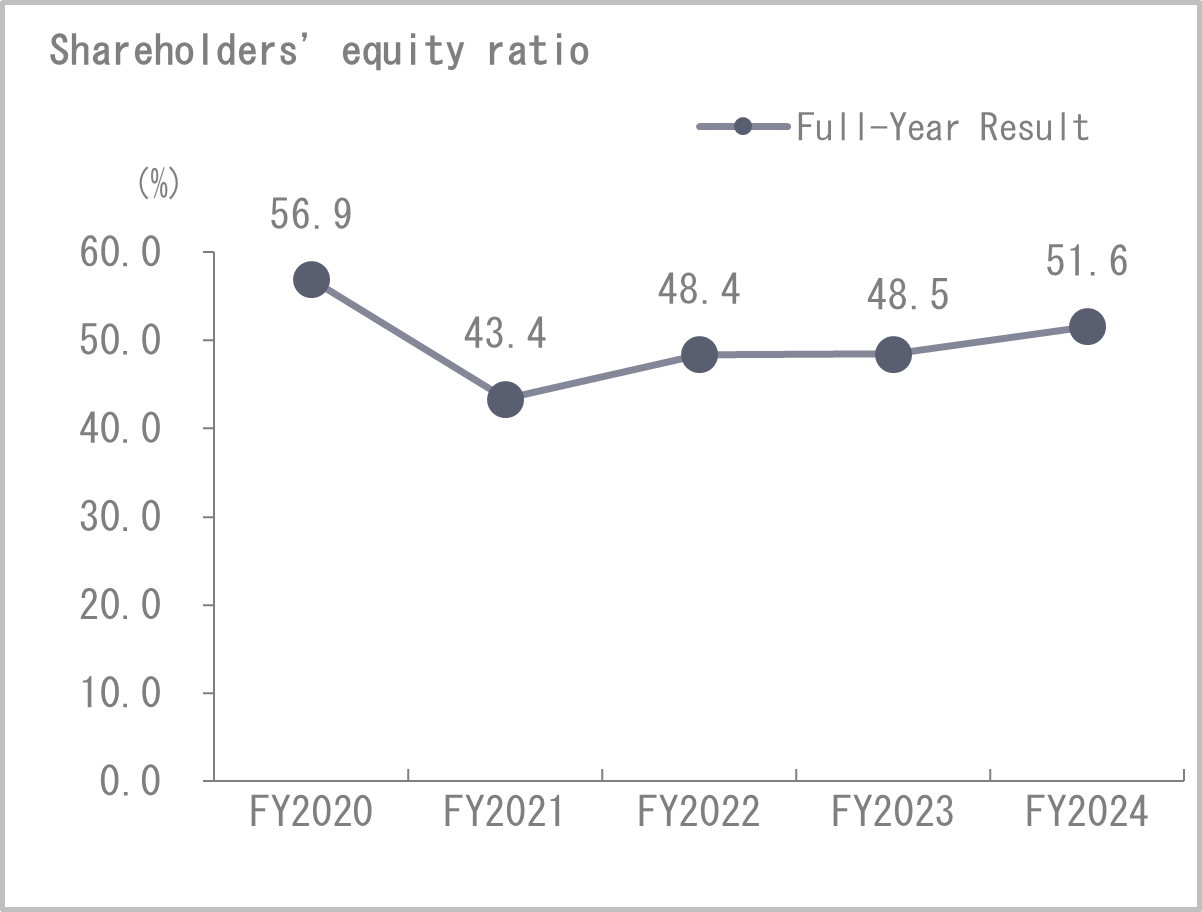

| Shareholders' equity ratio | 57.8 | 56.9 | 51.2 | 43.4 | 46.3 | 48.4 | 41.9 | 48.5 | 50.2 | 51.6 |

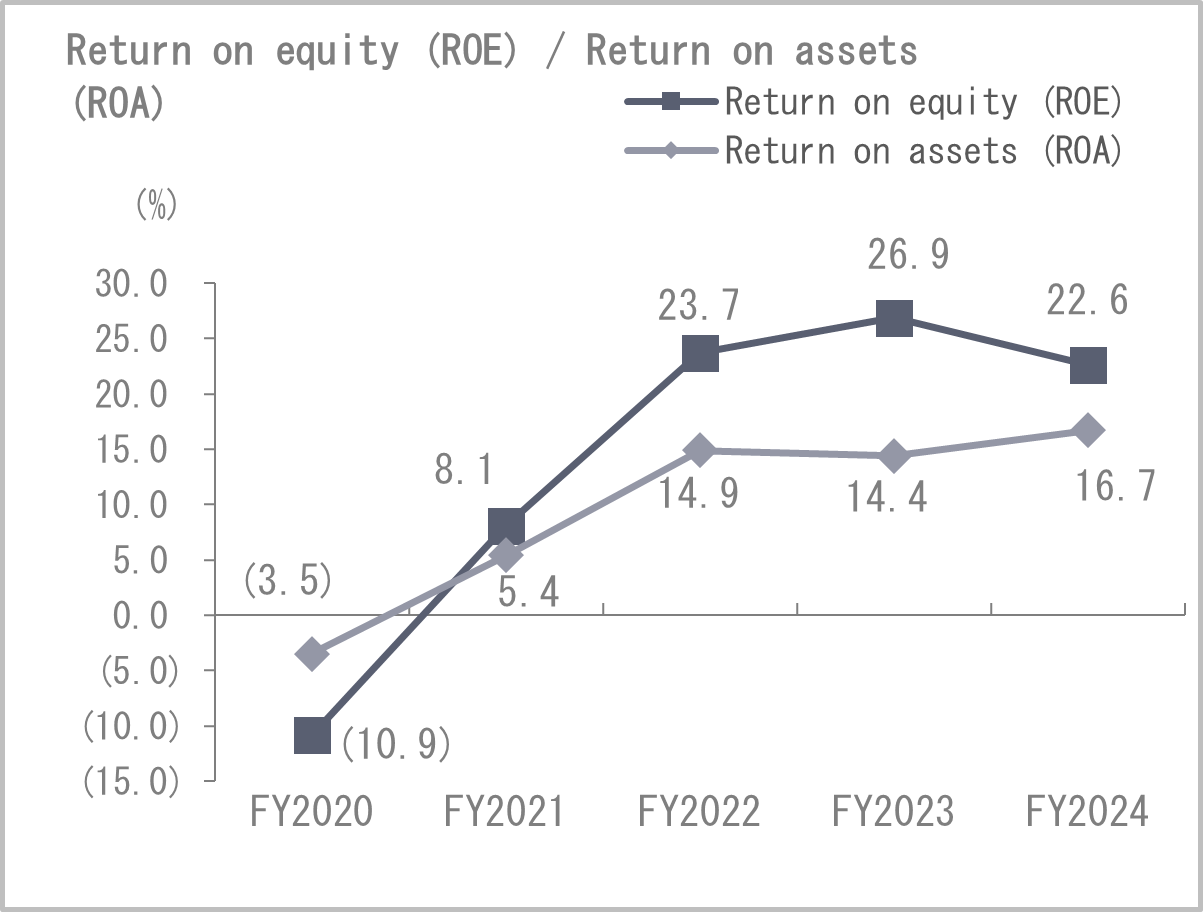

| Return on equity (ROE) | (12.4) | (10.9) | 1.1 | 8.2 | 8.1 | 23.7 | 10.4 | 26.9 | 6.2 | 22.6 |

| Return on assets (ROA) | (5.7) | (3.5) | 1.1 | 5.9 | 5.4 | 14.9 | 6.7 | 14.4 | 5.7 | 16.7 |

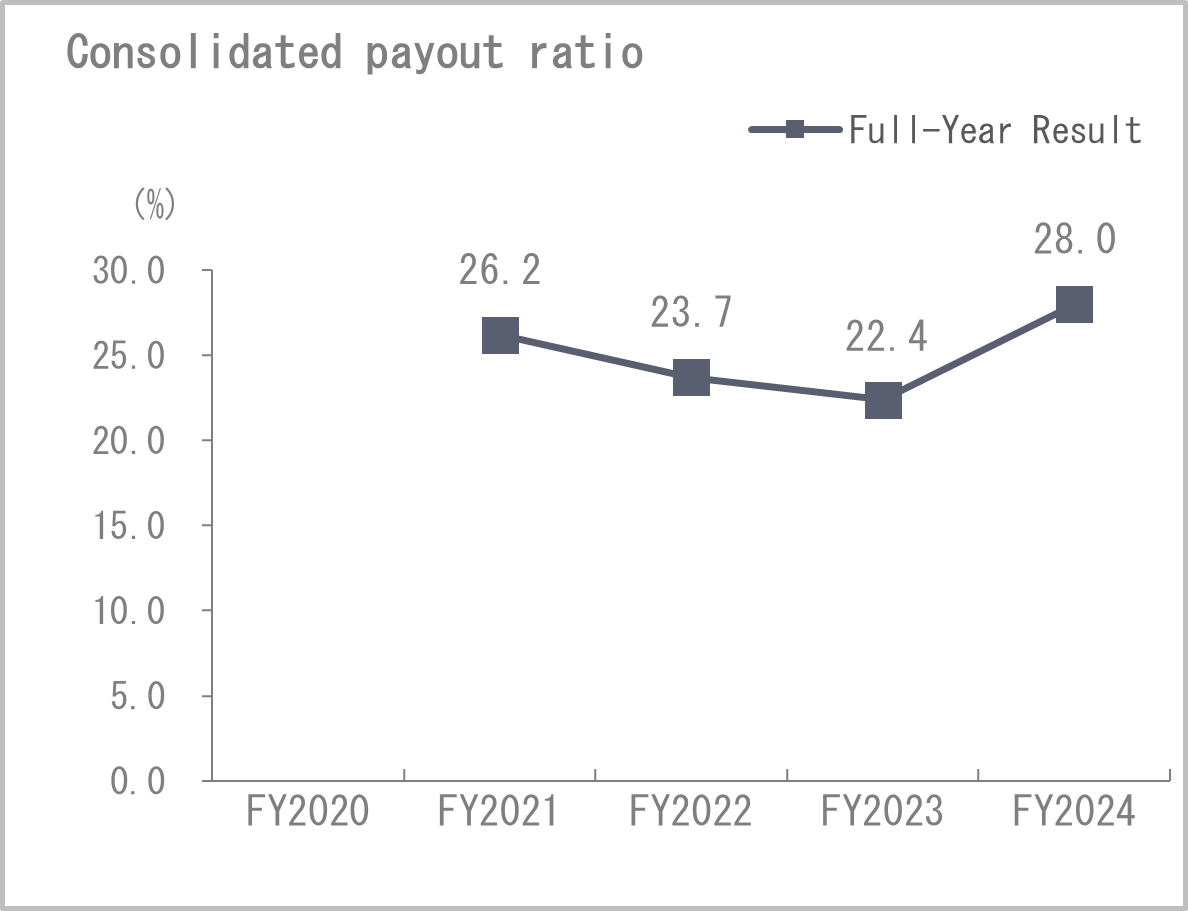

| Payout ratio (consolidated) *3 | - | - | - | 26.2 | - | 23.7 | - | 22.4 | - | 28.0 |

*3Consolidated payout ratio is indicated by figures for the full-year.

Other

| Year Ended March 31, 2021 |

Year Ended March 31, 2022 |

Year Ended March 31, 2023 |

Year Ended March 31, 2024 |

Year Ended March 31, 2025 |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| As of Sep. 30, 2020 |

As of Mar. 31, 2021 |

As of Sep. 30, 2021 |

As of Mar. 31, 2022 |

As of Sep. 30, 2022 |

As of Mar. 31, 2023*2 |

As of Sep. 30, 2023 |

As of Mar. 31, 2024 |

As of Sep. 30, 2024 |

As of Mar. 31, 2025 |

|

| Total number of shares issued and outstanding (thousand shares) | 34,700 | 34,700 | 34,700 | 34,700 | 34,700 | 69,400 | 69,400 | 69,400 | 69,429.15 | 69,429.15 |

| Treasury shares (thousand shares) | 2,368.30 | 2,368.30 | 2,368.30 | 2,368.30 | 2,368.38 | 4,001.38 | 3,972.84 | 3,970.85 | 3,259.90 | 3,212.70 |

| Number of employees (people) | 1,285 | 1,266 | 1,271 | 1,193 | 1,240 | 1,259 | 1,309 | 1,423 | 1,542 | 1,664 |

Net assets per share/profit (loss) per share for the fiscal year ended March 31, 2023 are calculated taking such stock split into consideration.

Dividends per share for the fiscal year ended March 31, 2023 are calculated taking such stock split into consideration.